News Update : Home Prices In Seattle Fluctuate, As Buyers Are Worried

The home prices in various counties of Seattle have shown a dip in recent months, which is historic. This is a major shift from the crazy high during and after the COVID period as high mortgage rates held homeowners from listing their homes creating a high demand-supply issue. Let us look at this latest trend to assist people willing to buy/sell their homes in Seattle in 2024.

Price Trends

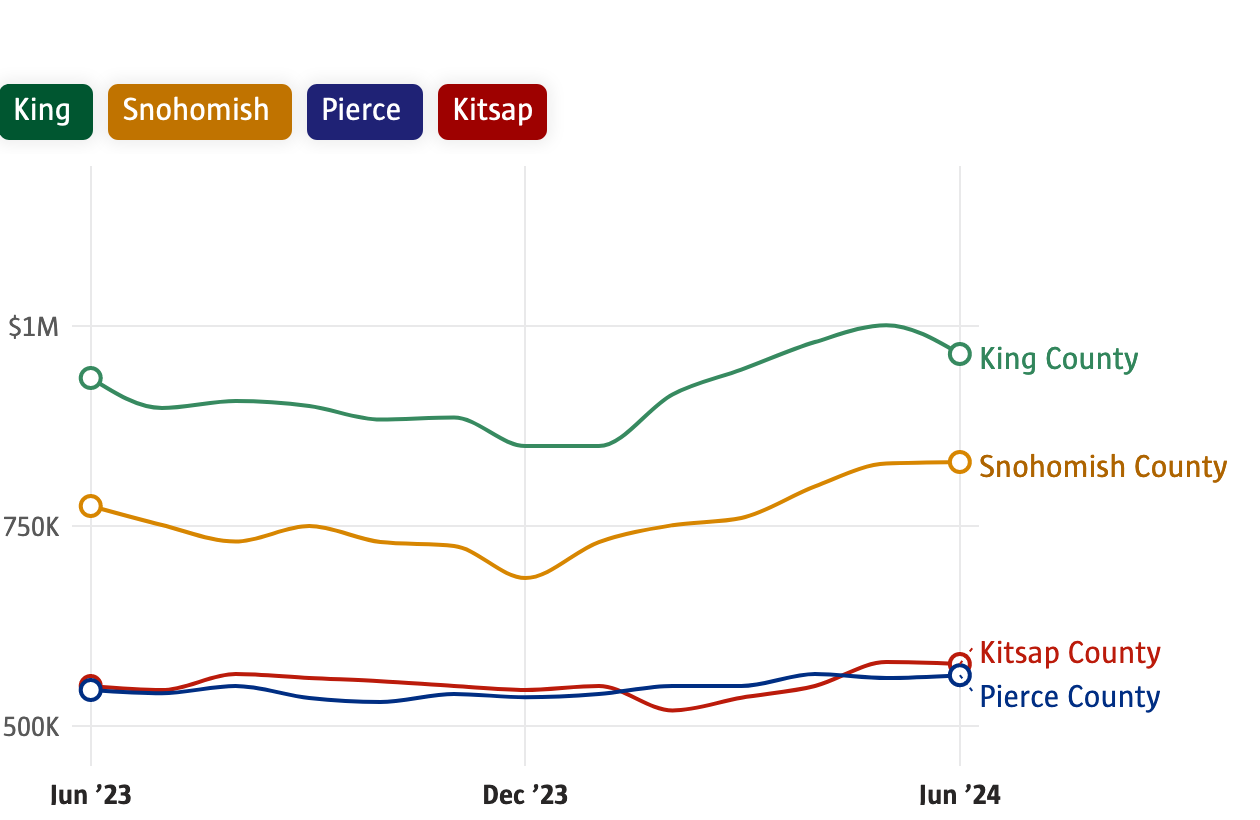

The median price for a single-family home in King County was $965,000 in King County, a slight decrease from May but still 3% more than last year. Similarly, Condo prices were down in comparison by May but 5% up from the previous year setting in at $555,000. However, there was a 13% rise on the Eastside for $1.6 million. In Seattle, it was $957,000, up 3% from the past year while the prices of condos did not show any change. Meanwhile, the median price per home in the Puget Sound area increased; in Snohomish County, it increased by 7% to $830,000, in Pierce County, it rose by 3% to $563,500; in Kitsap County, it grew by 5% to $577,500.

The Mortgage Rate Effect

Just like the previous two years, buyers' ability and their willingness to buy have been hit very hard due to the high mortgage rates which have roamed around 7% throughout the year. This is the highest rate in the past two decades which is predicted to rise more as inflation soars.

Buyer’s Remorse

High costs affected many homebuyers – they have had to put their search on hold. Home pending sales fell from May to June and either stagnated or declined from last year in the same region. Typically, the housing market activity is at a high in spring and low in summer since most people embark on their holidays. However, current conditions show that there are much more significant tendencies: buyers are faced with the problem of affordability fatigue and tend to postpone their purchases.

Market Insight

Some of the buyers had to make do with vacations due to high prices and demanding mortgage rates pointed out Mike Ferreri, an agent at Seattle Windermere. “Affordability has become a real problem to many buyers and the rates have not come down seriously,” said Ferreri. Heating, electricity, water, and insurance costs for homes increase, and if people have insurance included in their monthly mortgage payments, this adds to the financial burden.

One working in the Seattle Redfin, Bliss Ong said that 'the market has reached a stage where it is experiencing buyer fatigue.' She also said that 'many people are browsing the market.' While homes in the Seattle area were selling within about a week in May, they may now be selling below the listed price or with bonuses because there is a lot of willingness to negotiate. However, letting an expert like United Seattle help you in your search provides you with a good bargain as they know the market well.

Supply Vs. Demand

With buyers being held off due to inflation and the summer vacations, people are selling less as finding a new home amidst the high inflation and mortgage rates is also a potential headache. The listings have increased from last year but are still very low as compared to the pre-pandemic era. The buying vs. renting debate for first-time home buyers is heavily skewed in favor of the renting side making the demand even less.

The Way Forward

Home prices in Seattle's counties in the recent past dropped as a means of adjusting to the high mortgage rates and inflation. Standard buying a and selling b companies struggle to afford the products and services, they struggle to list themselves, thus experiencing a slower and more cautious market, which allows for more negotiations.

We Offer All the Services You Need in One Place! We Will Save You Time and Money!

Call Us at (425) 521-7916 Now to Get a Free Estimate or a Free Consultation for Any of Our Services!